Home > The Pocket Calculator Race

The Story of the Race to Develop the Pocket Electronic Calculator

Introduction:

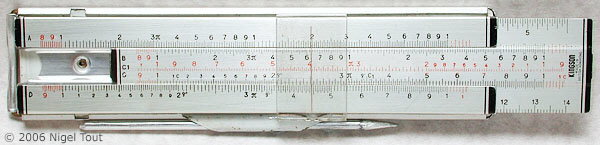

For hundreds of years performing complex calculations was a difficult and tedious chore. Multiplication, division, and taking square roots required paper and pencil and a lot of concentration. Some assistance became available with the invention of the slide rule and logarithm tables, and during the 20th century, if you could afford one, the development of mechanical calculators.

A typical small slide rule. Tens of thousands of slide rules were used by high-school students, university students, and scientists in the decades up to the 1970s.

It was during the 1960s and early 1970s that a great revolution in calculator technology occurred.

In the 1960s the first electronic integrated circuits were developed and manufactured in the U.S.A.. Although the early chips incorporated just a few transistors and other components, due to the reduction in the size of the circuit boards required they immediately saw use in hardware for the military and the "space race" with the U.S.S.R. Chips were also developed for use in the mainframe computers of the time where they gave increased functionality, together with the reduced size and cost.

One of the first consumer products to make use of integrated circuits was the electronic calculator. Indeed, during the late 1960s and early 1970s the development of electronics for calculators was at the forefront of technology and was often mentioned in electronics journals, and even in daily newspapers. The world was astounded in 1971 and 1972 when the first pocket electronic calculators became available in the shops and enabled everyone to carry a means to instant answers to their mathematical needs.

The pocket electronic calculator was also the first instance of a new phenomenon in the world of electronics; that of a product, previously unknown to the public, moving through its now familiar life cycle:

- Introduction of a completely new product, with high price, and often physically large.

- The product is desirable, the public start buying it in large numbers, so other manufacturers enter the market with competing models.

- Due to the competition and the economy of scale from the increasingly great numbers being sold the price falls dramatically and a large proportion of people buy one. Meanwhile the size is reduced, since more of the electronics is integrated into fewer integrated circuits, and more features are added. The product has now reached maturity.

In the years from 1970 to 1975 electronic pocket calculators went through this cycle, which had brought instant calculating power to the general public for the first time, but it had a drastic effect on many of the manufacturers who in the early days thought that these devices were the route to large profits. Since those years, other electronic devices have followed this cycle, including video cassette recorders, personal stereos, and mobile telephones. Being aware of this cycle, manufacturers now know that they have a lot of hard work in front of them to be still making a profit at the end of the cycle.

As well as this development cycle, calculators and their electronics were also involved in a technological and trade war between the U.S.A. and Japan, with other countries brought in on the sidelines. The story is told below using extracts from journals of the time.

The first electronic Calculators:

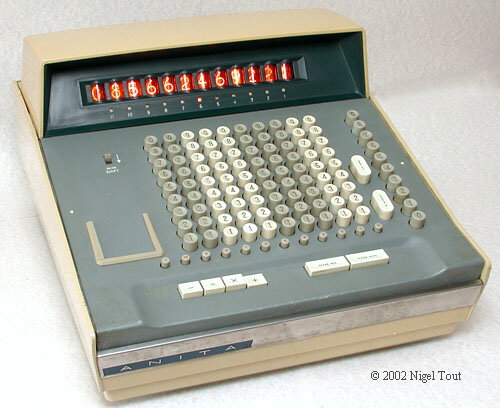

The first electronic desktop calculators, the ANITA Mk VII and ANITA Mk 8, were unveiled by the Bell Punch company of Britain in 1961. Although these were very successful, they were based on older vacuum tube technology. However, by the mid-1960s there were several other manufacturers around the world who had produced transistorised electronic desktop calculators. These were still large, heavy, and expensive machines since they required the use of dozens of individual electronic components.

ANITA Mk 8, from Britain, based on vacuum tube technology, 1961.

IME 84, from Italy, using transistors, 1964.

Although early models of electronic calculator were manufactured in several countries, in the late 1960s and 1970s there was especially fierce competition between U.S. and Japanese semiconductor companies and between U.S. and Japanese calculator manufacturers.

Friden EC-132, from U.S.A., using transistors and a crt (cathode ray tube) display, 1964.

Casio AL-1000, from Japan, using transistors, about 1967.

Largely as a result of developing electronics for the missile and space programs, and also of developing semiconductors for computers, by the late 1960s U.S. semiconductor manufacturers led the world in developing integrated circuits, squeezing more and more transistors, and hence functions, into each chip.

This led to, what now seem unusual, alliances between Japanese calculator manufacturers and U.S. semiconductor companies:

- Sharp (Hayakawa) with North-American Rockwell Microelectronics.

- Canon with Texas Instruments.

- Busicom with Mostek and Intel.

The alliances between the calculator manufacturers and the semiconductor companies brought the latest developments in electronics miniaturisation to the calculator manufacturers and led directly to the first hand-held calculators.

The result was that around 1970/1 the first hand-held calculators were launched on an astonished world that had only known mental arithmetic, slide rules, and expensive, and ususally large, clunky mechanical calculators.

Some of the first hand-held calculators (but not yet "pocket calculators"):

The Sharp Compet QT-8B using Rockwell-developed chips was the world's first battery-powered electronic calculator, launched in 1970.

The Canon Pocketronic using chips developed by Texas Instruments was one of the first "pocket" calculators - well it would fit in a very, very large pocket. It was introduced around late-1970/early-1971.

This calculator was developed from the Texas Instruments "Cal-Tech" experimental calculator, which led to Texas Instruments being granted the patent for the hand-held calculator.

The following sections contain items from contemporary publications illustrating the Story of the Development of the Pocket Calculator Business:

1) Calculator electronics at the cutting edge.

2) The U.S. leads in Calculator Electronics.

3) Japan starts to catch up in electronics

5) The Falling Cost of Calculators

1) Calculator electronics at the cutting edge

From about 1965 to about 1971 the development of integrated circuits for calculators was at the leading edge of electronics research, and took place almost exclusively in the U.S.A..

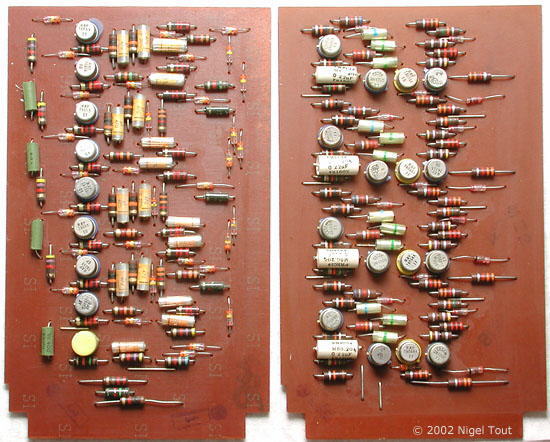

Two of the 33 circuit boards from an IME 84 of 1964, showing the tops of the metal cans, each of which houses a single Germanium transistor. The calculator uses a total of 424 transistors and 1074 separate Germanium diodes, together with hundreds of resistors and capacitors.

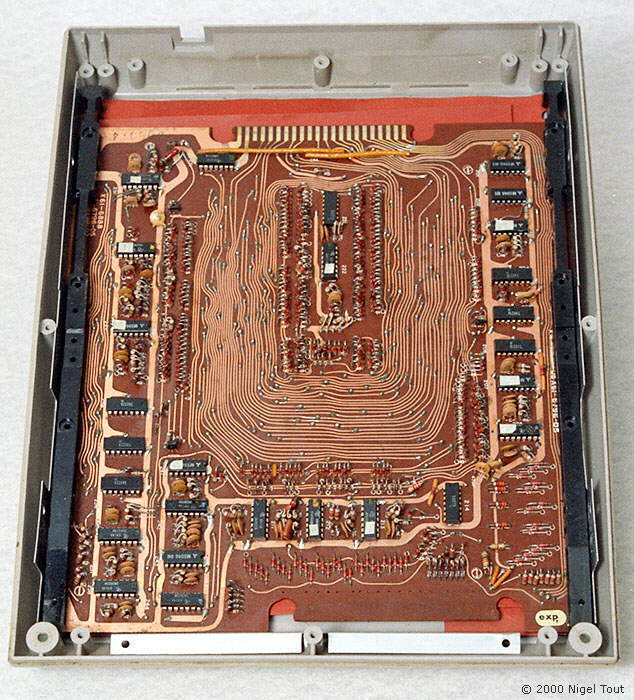

The single, large, double-sided, circuit board from a Canon Canola 1200 of 1969, showing some of the 48 silicon integrated circuits (the black rectangles) that performed the calculating functions just a few years later.

Each integrated circuit contains a number of transistors together with the equivalents of resistors and diodes.

One of the pioneers of integrated circuits for calculators was the Victor Comptometer Corporation, of the U.S.A. with its Victor 3900. The journal "Electronics" of October 18th

1965 announced: "The first commercial equipment to use metal-oxide-semiconductor (MOS) integrated circuits will be introduced at the Business Equipment Exposition in New York City

next week when the Victor Comptometer Corp.'s Victor 3900 makes its debut. The desk-top calculator uses MOS ICs that contain 250 transistors each. The integrated circuits are made by General Micro-electronics, Inc."[1]

However, General Micro-electronics had great difficulties making the integrated circuits and the Victor 3900 only appeared in prototype form, its launch

being dragged out over several years before being finally abandoned.

By summer 1968 the use of integrated circuits in calculators was gaining momentum, as described in the journal "Electronics" in an article about the Tokyo Business Show: "Only one of the 14 desk-calculator producers at the show had only discrete-component machines to offer. This was the Tokyo Shibaura Electric Co. [Toshiba]; it, too, will start marketing an IC model in September."[2]

Sharp of Japan was one company that was aware that if enough electronics could be packed into a few integrated circuits then a hand-held electronic calculator was possible. A team of system design engineers, headed by Yukihiro Yoshida, was sent to Rockwell where, with the support of Rockwell's design capability, they set about implementing the required set of MOS-LSI circuits by using the four-phase MOS dynamic logic which was originally developed by Rockwell.

The journal Electronics in November 1968 showed the photograph above of an experimental calculator from Sharp, using the latest developments in integrated circuits, with the following description: "This is the miniaturized experimental calculator that was developed by Hayakawa [Sharp] using large scale integration techniques. On the board are 11 MOS integrated circuits with 300 to 400 elements apiece, three bipolar hybrid IC's, and four bipolar transistors. Using government money, the Japanese company expended $42,000 on R&D and figures another $130,000 will be spent designing the commercial prototype that's due next March. The machine shown here is just 2.8 inches high, 6.3 wide, and 8.7 deep."[3]

After a few years of hard work the design team succeeded in developing a LSI calculator, the Sharp Compet QT-8D, based on just four MOS-LSI chips produced by Rockwell. Launched on the market in August 1969 this model, compared to other calculators of the time, had a drastically reduced price of about US$300, weight of 1.4Kg (2.5 pounds), and power consumption of 4W, using 4 MOS-LSI's and an 8-digit display using newly developed vacuum-fluorescent (VFD) tubes.

Since the power consumption was now very low it was feasible to add a rechargeable battery power supply to the AC-only QT-8D to form the Sharp Compet QT-8B, and so produce the first hand-held calculator.

There are more details of the role of Sharp Corporation in the development of electronic calculators in the Calculator Companies section.

However, the change to the use of integrated circuits was not all smooth, as can be seen from an article in the journal "Electronic Design" in January 1971 entitled "Use of LSI in consumer areas

picks up, but problems remain": "The age of medium and large-scale integration is at hand for a host of consumer products, including an alarm-clock radio with digital readout, electronic musical instruments,

small calculators home appliances and wrist watches. But according to a survey by ELECTRONIC DESIGN a number of problems remain to be solved - namely cost and device testing. Agreement seems to be universal that the

particular problems associated with LSI testing will tend to keep costs up.

Charles V. Kovac, vice president of marketing, North American Rockwell Microelectronics Co., Anaheim, Calif., says 'The vast majority of MOS/LSI

produced in 1970 went into electronic calculators.'"[4]

2) The U.S. leads in Calculator Electronics

For many years, from the 1960s, there was great rivalry between the U.S. and Japan electronics industries. To a certain extent development was funded in the U.S. by contracts for military and space projects, whereas in Japan the Ministry of International Trade and Industry (MITI) judiciously subsidised research and development in electronics companies.

An example of the rivalry was a patents dispute between Texas Instruments (TI) and Japanese calculator manufacturers in the late 1960s. TI held some of the basic patents for integrated circuits and was not allowed to set up manufacturing facilities in Japan, so it demanded royalties from the Japanese calculator manufacturers for their use in calculators. This is illustrated in this news item from the Journal "Electronics" of September 1967:

"Hayakawa may test TI on IC patents

The long-standing hassle over integrated circuits between Texas Instruments and Japanese electronics interests may come to a head this fall. Although the TI-Japan patent snarl remains as entangled as ever, the Hayakawa Electric Co. [later to change its name to Sharp] is poised to export desk calculators with IC control circuits to the U.S.

The company will decide when to leap after it gets the results of a mid-September meeting between U.S. and Japanese trade officials. Japan's tiff with TI will be on the agenda, but there's little chance of a solution. Unless it looks like TI can get a court order to have the calculators seized; Hayakawa may take the gamble. Legal action by TI would also involve the Mitsubishi Electric Corp., which supplies the IC packages for the calculator.

Hayakawa's sortie into the U.S. market with an IC product apparently will have the blessing of the powerful Ministry of International Trade and Industry. MITI last spring warned Japanese producers not to export IC hardware until licenses had been arranged with Fairchild Camera & Instrument, which holds the basic U.S. patents on the planar process. With the exception of Matsushita Electronics and Sony, Japan's major IC producers have acquired rights to Fairchild's patents. But TI, which also owns basic IC patents, has been holding off on licenses because its bid to set up a wholly owned subsidiary has been turned down by MITI.

Hayakawa executives insist they're looking for a desk calculator market in the U.S. rather than a run-in with TI. The company is geared for mass production of its calculator and needs the large American market as an outlet. But TI can hardly let Hayakawa's move go unchallenged. Other Japanese firms are itching to export IC products and figure to follow Hayakawa once it establishes a beachhead."[5]

This dispute was resolved when TI was allowed to set up a joint venture in Japan with Sony to manufacture integrated circuits and allowed the granting of licenses to allow integrated circuits to be used in calculators.

In November 1970 the journal "Electronics" reported:

"Just how successful U.S. calculator makers will be in turning back the Japanese invasion depends largely on the ability of U.S. semiconductor manufacturers to maintain a

lead in MOS/LSI technology", says Gregory [Earl Gregory, vice president of Electronic Arrays]. "Today that LSI technology is centered in the U.S. The Japanese are aggressive about getting that ability, but the U.S.

companies won't be sitting still in MOS/LSI either. You have to have the knowhow to bring out new functions, and that knowhow isn't automatically transferred with technical assistance agreements", he declares.

Currently,

Japanese companies such as Canon, Sharp, and Seiko are buying large quantities of LSI for their calculators from NRMCO [Rockwell], Texas Instruments, and Intersil.

Sales of [electronic] calculators in the U.S. this year are

expected to hit $241 million at the retail level, a 62% rise over 1969 despite current business conditions. And "there's absolutely no sign of a shakeout", says one U.S. manufacturer. "On the contrary," he says, "at

least three new units are being introduced each month." The big push now by most makers is to get their lowest-priced units down to the $100-$200 level - low enough to attract the potentially vast consumer market.

While

Japanese import account for 65% to 70% of retail unit sales, they account for only half of the dollar sales. But the Japanese hope to raise this total by introducing the more expensive memory-type calculators. Factory

shipments to the U.S. from Japan amounted to $35.65 million on 1969, or 112,000 units. Through the first nine months of 1970 these figures rose to $55.89 million and 220,000 units. Total Japanese shipments were 441,000

units, worth $164.4 million in 1969. By the first half of 1970 factory shipments equaled all those of 1969, totaling 519,000 units worth $142 million.

In 1971 Japan's total factory shipments are expected to reach 2.75 million

calculators valued at $661 million ...

Next year will be the first for true mass production of LSI arrays in Japan. Four companies will be doing most of the manufacturing. Hitachi and Toshiba will concentrate on

semi-standard arrays, designing their circuits around arrays used in calculators made by their other divisions, while Nippon Electric and Mitsubishi, neither of which make calculators, are concentrating on arrays made to

customer's' orders.

Sharp Corp. leads the calculator industry in Japan, producing close to 40% of all units. Canon Inc. runs second with about 15% of the market and Casio Computer Co. Ltd. produces about 12%."[6]

In 1970 "Electronics" journal said that by 1971 nearly 50% of the worlds production of MOS ICs would be for use in calculators. Also it will be the first year for true mass production of LSI chips in Japan, mainly by Hitachi, Mitsubishi, Nippon Electric, and Toshiba.

The birth of the microprocessor ...

The journal "Electronic Design" reported in February 1971 "At

Intel Corp., Mountain View, Calif., a single-chip central processor unit is being tested for a Busicom, USA, calculator. It will be used with custom ROMs and RAMs for programming and memory."[7]

The central processor unit was the Intel 4004, the first successful microprocessor. Intel immediately realised that this chip could have a wide range of uses in all kinds of

equipment, depending only on the program used with it, and were soon pushing this "microprocessor" to the electronics industry. From this, over the next 30 years, were developed the 8008, 8080, 8086, 80286, 80386, 80486, and

Pentium processors. It is notable that Pentium processors still implement the Binary-Coded Decimal (BCD) instructions that the 4004 used for the calculator arithmetic.

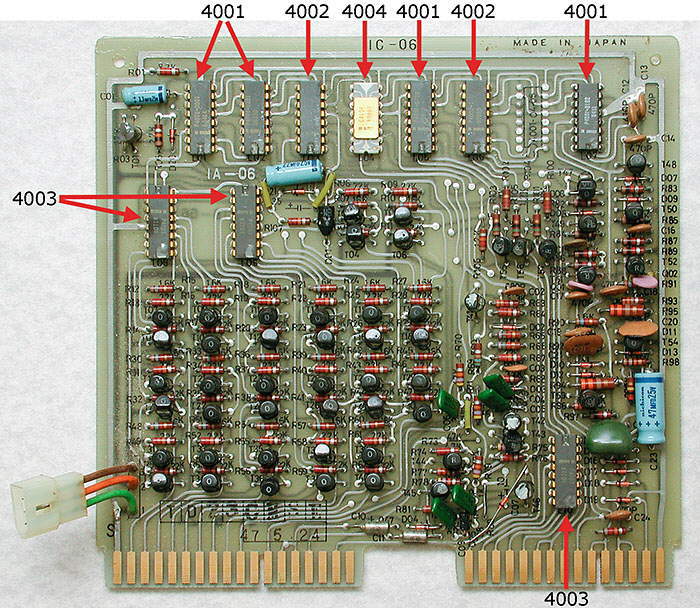

From the Busicom 141-PF calculator, for the first time ever, the classic microprocessor system of:

- The 4004 microprocessor

- The 4001 ROM (Read-Only Memory)

- The 4002 RAM (Random-Access Memory)

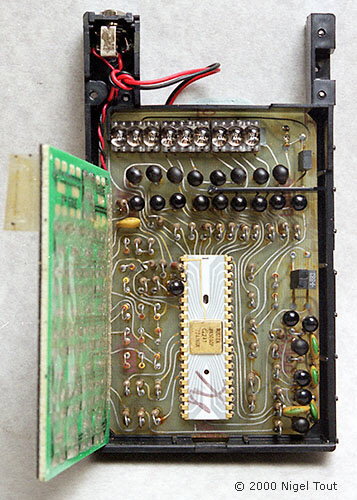

The Busicom 141-PF calculator (here badged for sale by NCR (National Cash Register) which contains the circuit board above.

For the full fascinating story see the article "The Calculator that spawned the Microprocessor: The Busicom 141-PF calculator and the Intel 4004 Microprocessor" on this site.

Enter the "calculator on a chip" ...

From the mid-1960s one of the aims of the electronics industry was to integrate

more of the functionality of a calculator into fewer integrated circuits. This culminated in the "calculator-on-a chip", where the whole functionality of a calculator was provided by a single integrated circuit.

While

Busicom had contracted Intel to develop the 4004 microprocessor, this very innovative Japanese calculator manufacturer had also commissioned Mostek of Dallas to push the limits of integration of calculator electronics. The

result in late 1970 was the Mostek MK6010, the first "calculator on a chip" which was immediately put to use in the Busicom Junior small desktop calculator.

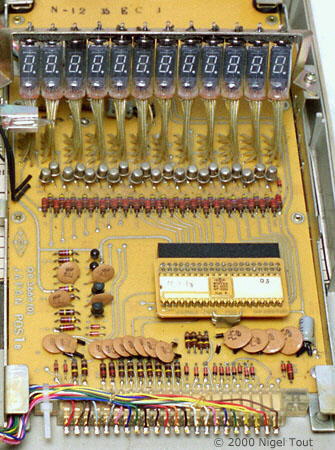

The cover of a Busicom Junior calculator has been removed to reveal the circuit board showing the single Mostek LSI chip mounted on a plug-in chip carrier.

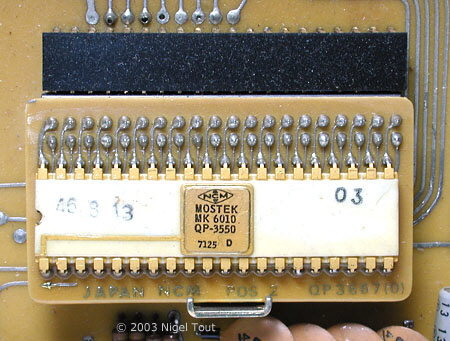

Cutting edge technology of 1971, the Mostek MK6010 "calculator on a chip"in a Busicom Junior calculator. The integrated circuit illustrated is date coded 7125 (i.e. 1971, week 25) and is also marked with the NCM (Nippon Calculating Machines) logo.

The IC is mounted on a small piece of circuit board which plugs sideways into the black socket.

"Calculator on a Chip"

The magazine "Electronics" for Feb 1st. 1971 proclaimed[8]:

"The apparent winner in the race to produce a calculator on a chip has hit the wire. Mostek Corp., of Carrolton, Texas, is now producing such a chip for Japan's Busicom Corp. ... The 180-mil-square [0.18 inches-square (4.6 mm-square)] chip contains the logic for a four function 12-digit calculator - more than 2,100 transistors in 360 gates plus 160 flip-flops. Its promise of lower labor costs means a giant step toward a calculator for the consumer market. ... ... Busicom's initial use of the chip will be as a direct replacement in its Junior model calculator now being distributed in the U.S. by National Cash Register."

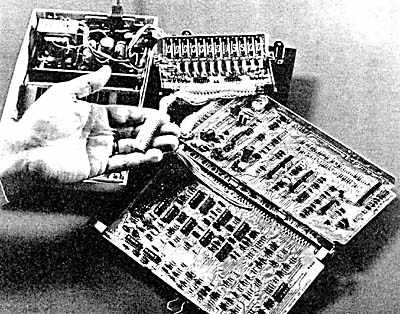

The chip held in the hand replaces the two circuit boards full of components, including 22 MSI (Medium Scale Integration) integrated circuits.

The single chip, using a p-channel semiconductor process, replaced 22 chips in the previous version of this Busicom Junior calculator and reduced the number of circuit boards from two to one. Note that separate transistors were still needed as high-voltage display drivers.

The article continues ... "The original calculator's discrete diode-resistor and IC logic was a very clever design, says Mostek, developed over many years and requiring nearly the minimum logic necessary for a four-function machine. ... the minimised logic contributed greatly to Mostek's success in putting a calculator on a single chip". Mostek of Dallas was then less than 2 years old.

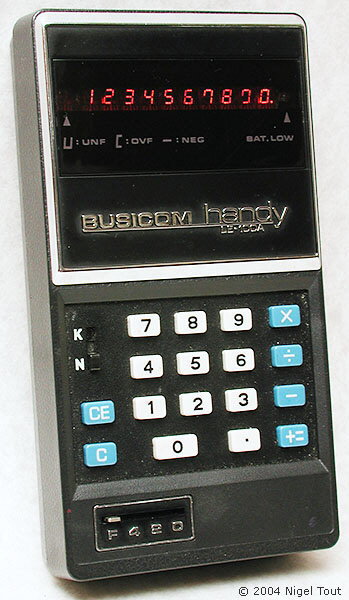

The introduction of this "calculator-on-a-chip" allowed the production of the first true pocket calculator, the Busicom LE-120A "HANDY"

Busicom LE-120A "HANDY" using the MK6010L "calculator on a chip" developed by Mostek. This was the world's first true pocket calculator, small enough to fit in a shirt pocket, and also the first calculator with an LED (Light-Emitting Diode) display. It went on sale in early 1971.

The article was very prophetic when it said "Its promise of lower labor costs means a giant step toward a calculator for the consumer market", and the competition was soon on Mostek's heels, since also in February 1971, "Electronics Design" reported "Two days after Mostek announced its development of a calculator on a chip, another Dallas-based company Texas Instruments said that it, too, was completing development of a one-chip calculator that would be available "off-the-shelf" by June."[7]

The Busicom LE-120A was very expensive, with a 12-digit LED display and a die-cast aluminium casing, and was out of reach of the man (and woman) in the street. Electronic Design reported in the article "The one-chip calculator is here, and its only the beginning" that there would be two models, one with LED display with a U.S. selling price of $395 and a Liquid Crystal Display version that would be somewhat cheaper[9]. However, the Liquid Crystal version was only produced as a prototype and never went on sale.

It was evident that the price of the pocket calculator had to be reduced and soon Busicom launched a new, cheaper model using a Texas Instruments "calculator on a chip", the TMS0106, a 10-digit display, and a plastic casing. Other companies were also looking at making a profit by selling cheaper pocket calculators.

The later Busicom LE-100A "handy" pocket calculator used the Texas Instruments TMS0106 "calculator on a chip".

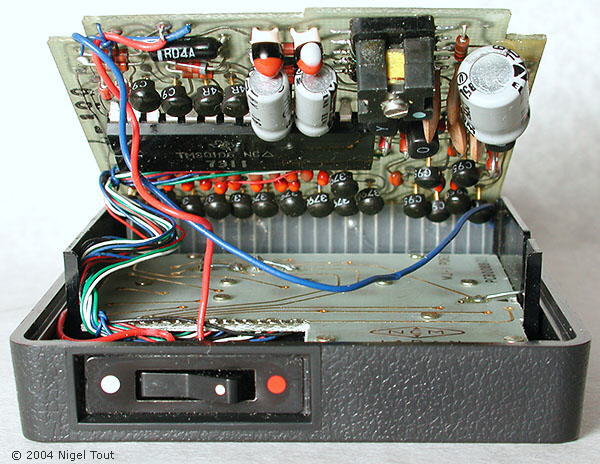

On the small circuit board in the Busicom LE-100A the black package of the Texas Instruments TMS0106 "calculator on a chip" integrated circuit can be made out on the left, behind the components at the front.

See the article "The Calculator-on-a-Chip" on this site for further information about this development.

The first pocket-sized electronic calculators, made possible by this high degree of electronic integration, were astounding at the time and were miracles of technology. However, being on the cutting edge of technology they were also extremely expensive, but that was to change.

There were other consequences to the introduction of the "calculator on a chip". In 1972 the journal "New Scientist" said "The adoption of LSI was foreseen by most calculator manufacturers, but commercial pressures brought

it about faster than generally anticipated. As a result, the Japanese calculator manufacturers - who, by 1970, accounted for the bulk of the world market - found themselves at a disadvantage because the Japanese components

industry could not supply them. In 1971, no less than 80 per cent of the LSI chips installed in Japanese calculators were reckoned to have been directly imported from the United States and, although Japanese manufacture is

increasing rapidly, nearly all Japanese manufacturers are still dependent on US technology in this area."[10]

"Challenging Japanese domination of the business calculator market, Americans are exploiting their technology not merely exporting it"

In September 1972 the journal "Electronics" reported[11]:

"Yankee ingenuity and Japanese initiative are locking horns again in the calculator arena, this time over business calculators—machines priced at $200 or more.

And old-line U.S. calculator makers such as Victor Comptometer, Monroe, and Singer are turning to electronics to regain a big chunk of business calculator sales they lost when Japanese manufacturers beat them to the punch in applying new U.S. technology, particularly MOS LSI,

Japanese calculator makers quickly exploited the advantages of MOS LSI in the class of calculators now known as consumer machines—those selling for $100 or less. But that's an entirely new market. Traditional U.S. builders of electromechanical machines didn't lose business to Japan when firms in that country began cashing in on the market's readiness for the simple four-function machines. Now American builders of consumer calculators are finding they can make and sell machines profitably for $100 or less, and are providing keen competition for Japanese firms.

The same thing is now happening in the more expensive calculators—those offering such functions as square root, percentage, and memory. The major U.S. makers are converting from electromechanical to electronic machines, thereby reaping the benefits of reduced costs through mechanized processes as U.S.-developed MOS LSI technology gets more and more calculating functions on a chip. This approach to cost reduction is upstaging the former advantages of cheap labor for offshore assembly and Japanese manufacture of the machines to be sold by American firms on an OEM basis.

But the low assembly costs aren't solely responsible for the resurgence of American manufacturers of the middle-range calculators. Their responsiveness to the market's desire for electronic printing calculators is also a factor.

...

"The reason the Japanese got the market to begin with," says James Sheridan, president of the Monroe Calculator division of Litton Industries, "is that the U.S. did not realize what solid state could do for the electromechanical calculator. The Japanese did. We were caught off guard." Ned Salisbury, planning director of the Singer Co. Business Machine division adds, "Friden [a Singer acquisition] introduced a $2,000 transistorized calculator in 1964, but we didn't realize the significance of it."

In 1969, Japan's Sharp was the first to successfully apply MOS to business calculators. Using a systems approach, the company introduced a calculator having circuitry designed and provided by North American Rockwell Micro-electronics Co. "Around this time," says an industry spokesman, "American firms feebly tried to buy circuits on a standard basis with short-term commitments and second-source arrangements, and the result was failure." However Victor Comptometer Corp., Chicago, one of the first U.S. companies to utilize the systems approach, established a long-term agreement with NRMEC, comments Victor Business Products division president, J.E. Smith.

The major manufacturers competing for an edge in the U.S. business calculator market include: Bowmar ALI, Acton, Mass.; Burroughs Corp., Detroit; Commodore Business Machines Ltd., Santa Clara, Calif; Displaytek Corp.. Dallas; Keystone Business Machine Co., Paramus, N.J.; Monroe. Orange, N.J.; SCM Corp., New York; Singer, New York; Unicorn (being acquired by North American Rockwell); and Victor Comptometer Corp. Japanese contestants include Brother, Casio, Canon, Hitachi, Omron, Sharp, Ricoh, and Seiko Time Corp.

...

... the European market for business calculators is up for grabs. Both the U.S. and Japan are gunning for control, despite the resident old-line European business calculator manufacturers. In addition to Philips, they include Precisa AG of the Paillard Group (Hermes), Switzerland; Olivetti, Italy; and Facit-Odhner, Sweden.

Burroughs has a foot in the door with an assembly plant in France, and other U.S. companies already in Europe are Monroe, Singer, and Bowmar. And Victor's Smith says that his company is considering setting up an overseas operation.

Most Japanese manufacturers have already penetrated the European business calculator market. Albert Schaerer, marketing manager at Precisa says, "The European calculator market is in a state of change. The Japanese dominate, but they are losing ground to the U.S." Schaerer says that if American companies are fast in coming out with good printers, they will capture both the European and the world market for middle-range calculators.

But a Canon spokesman says, 'The addition of more U.S. calculators to the Japanese effort will make more unhappiness for the European companies." A Philips spokesman points out that, until recently, European makers bought Japanese business calculators, selling them under their own names, but that practice has diminished. 'The result," he says, "is that the Japanese trade name is relatively new."

"The Japanese will have to be more aggressive, out of necessity," concludes Singer's Salisbury. "But there is also a great potential market in the developing countries of South America and Africa, and there again, the share of the market is Anybody's game." "

In May 1973 the journal New Scientist reported[12]:

"It was the advent of LSI (large-scale integration) circuitry - offering up to 7000 transistors on a single minute chip of silicon— which caused calculator manufacturers to spring up literally in backyard factories across the globe. All they needed was a handful of chips, some keyboards and displays and they were in business", one importer remarked wryly. The components were bought out from major electronics firms and assembled and packaged in-house. A small printed circuit connects the chip and display to the keyboard contacts. With all the logic and working registers being encapsulated in a single plug-in component, the circuit wiring is thus minimal. This fact, plus recent inflation and revaluation in Japan, has swung the production advantage away from Japan, with her massive supply of cheap wiring labour, towards America where all the necessary technology is close at hand.

3) Japan starts to catch up in electronics

The journal "Electronics" reported back in June 1968 on the Tokyo Business Show that there was an increase to 34 models of electronic calculators from 14 Japanese companies on show: "The reason for the widespread itch to manufacture electronic calculators isn't hard to find. Some 2.6 million small calculators - mostly mechanical - are sold each year throughout the world, and the Japanese intend to capture this growing market with their electronic machines. They expect to turn out some 200,000 electronic calculators this year, more than three times last year's output. By 1970, the figure should climb to 500,000 machines - nearly half of them for export, principally to the U.S."[2]

A special report in the journal "Electronics" in 1972 on the Japanese semiconductor industry[13] said "The wild pace of calculator growth has turned the

Japanese semiconductor market into an uproar. In an all-out dash to keep up with the demands of calculator manufacturers, domestic [Japanese] MOS makers have developed MOS LSI devices, knocked the stuffing out of prices, and

re-arranged the market shares of domestic and foreign producers to a 50-50 split. In doing so. the shaky domestic semiconductor manufacturers have found solid and profitable footing. In contrast to the U.S. experience,

some leading calculator manufacturers have even started producing their own integrated circuits.

In 1972, domestic semiconductor houses have captured 50% of the MOS LSI market, previously dominated by Americans Texas

Instruments, Mostek Corp., National Semiconductor Corp., and North American Rockwell Microelectronics Corp. This remarkable catch-up by Hitachi, Toshiba, NEC, and Mitsubishi probably could not have been accomplished in such

short time had it not been for the large-volume demand from the calculator manufacturers. This gave them the chance to produce in large numbers and improve yields, thus matching U.S. prices.

The technical edge enjoyed by

U.S. companies has all but vanished - at least for the level of sophistication required in calculators - so the competition will center on those other semiconductor standbys—price and delivery. The situation may spell

the end of the ability of U.S. companies to snag sales in Japan on the basis of a technical headstart. It's become much easier for Japanese competitors to close the gap. Convinced that this new game puts anyone

without a joint venture on a greased pole, Motorola and Fairchild are setting up 50-50 joint ventures with Alps Electric Co. Ltd. and TDK Electronics Co. Ltd., respectively. Part of their reasoning is that a technical lead

may gain orders early for the outsider, but it does not offer an opportunity for longer-term penetration of less exotic lines, such as TTL, bipolar, and linear ICs. (The TDK. venture is actually Fairchild's second try to

establish a foothold in Japan.)

Tl challenged

Tl's lead, created with resounding impact by the calculator-on-a-chip package, has been challenged, but the company is confident that its market share is

intact. In fact, TI has started construction of a second plant in Japan, scheduled to go on line by the end of 1973. (TI gained a unique position when it won permission to set up its joint-venture with the understanding

it could convert to full ownership after a three-year period.)

"By anticipating the learning curve of calculator chips, we were able to match production costs with the drop in calculator prices" comments William Sick,

president of Texas Instruments Asia. "Not everybody saw this, and they were not ready with MOS LSI when the time came. This put a strain on producers trying to match our price."

Key to catching up by the

Japanese, says Toshio Inoue, deputy general manager for Hitachi's Electronic Devices group, was closing the gap in computer-aided design and acquiring American processing equipment. Japan's big calculator business did

the rest. Although Hitachi is supplying Casio with devices for the first under-$50 calculator in Japan, Inoue believes that the road to better profits is in the other direction—toward more complex functions on single

chips designed for higher-priced machines."

The U.S.A. semiconductor manufacturers reacted to their Japanese rivals developing LSI chips for calculators. This was noted in the journal "Electronics Today International" in August 1974[14]:

"JAPAN LOSES GRIP ON CALCULATOR MARKET

There have been dramatic changes in the world market for electronic calculators in the last two years. The American

manufacturers have seized the initiative from their Japanese rivals, while prices have dropped like a stone and the number of units sold soared to an estimated 15m worldwide in 1973.

A new report shows how the value of Japanese calculator production has actually declined, despite a huge increase in the number of units produced, while the Americans have forged ahead. The average price of calculators leaving Japan fell from about £115 in early 1971 to about £26 by late 1973. From 80% of the world calculator market in 1971, Japan's slice fell to 40% in 1973.

American companies realised that their LSI technology was being exploited by their Japanese competitors and decided to start using the circuits themselves, with great success. LSI technology allows all the computing circuitry needed in a calculator to be carried on a few tiny chips of silicon. This is what has made the pocket calculator boom possible, but producing the chips demands high-level technology and long production runs to be economic. The Americans are far ahead of the rest of the world in LSI.

Big Japanese manufacturers (such as Sharp which made about 2 million calculators in 1973) are building up their own LSI capability in the struggle to stay ahead. The value of Japanese calculator manufacture fell from 132 billion Yen in 1970 (about £200m) to an estimated 111 billion Yen in 1973, even though the number produced soared from 1.4m to 10m..

In the USA Bowmar, by far the biggest specialist in the field, increased its total sales from $ 3m in 1971 to $64m in 1973, largely as a result of its entry into calculators. Other big US calculator manufacturers include Rockwell International, prime contractor in the moon-landing programme, Texas Instruments, the world's biggest manufacturer of integrated circuits, and Hewlett-Packard which is specialising very successfully in sophisticated financial and technical calculators.

The US manufacturers are moving rapidly into Britain. Rockwell, for example, last year took over Britain's largest calculator manufacturer, Sumlock Anita, and Texas Instruments has set up a large plant to make calculators at Plymouth. As far as sales in Britain are concerned, Japan accounted for just over 25% of the £26m calculator imports in 1973, slightly ahead of the USA, with Italy, West Germany, Singapore, Canada and Hong Kong following behind in that order. Altogether an estimated 810,000 calculators were supplied in Britain last year.

The future is expected to see a continuing rapid increase in the number of calculators sold, but a much slower growth in the value of the market. The Japanese manufacturers are already showing signs of closing the technology gap in LSI, and also in producing calculator displays. The Americans now have such a strong lead in the market that they are unlikely to lose it—unless the Japanese can come up with a major technical innovation.

The strongest possibility of breaking this barrier is with the thermal printer. At present calculators which print out their results take a relatively small share of the market, because of their high cost. Many commentators believe that if the £100 price barrier can be broken, a very large market would be opened up. In the thermal printer, heat-emitting components reproduce numerals as a pattern of fine dots on sensitised paper. The mechanism promises to be silent, fast, reliable, easy to manufacture and cheap. The drawback at present is that it needs expensive special papers. The first manufacturer to find a way round this problem will have a valuable lead in the printing calculator market."

5) The Falling Cost of Calculators

Up to the early 1970s calculators were, in general, specialised and expensive machines. They were sold through specialist dealers, who could provide back up such as training and servicing, but who also had a high mark up on

the price. Calculators were considered by manufacturers and dealers as high profit-margin items, and it was unthinkable that calculators could be sold cheaply by untrained people in chain stores.

This was reflected in the

profits made from production to sale:

The journal "Electronics" in March 1972 reported that[15] "U.S. calculator makers say that they can't build and market machines profitably unless the selling price is about four times the cost of components—assuming that they're selling through business machine dealers or direct salesmen. Going to low-overhead operations and selling directly to retail outlets lowers the price to three times the components cost.

Early last year [1971], MOS chip sets for four-function calculators consisted of three to five arrays that sold for a total of about $40. The other principal part costs broke down this way: keyboard, $20; display, $20; power supply and other electronics, $10; and case, key caps and other external hardware, about $5. This adds up to about $95, dictating a selling price of $395.

Most calculator makers agree that to produce a machine designed to retail for $99, it must have a parts cost of $25. ...

... That doesn't leave much profit margin, but there are signs that the $25 parts cost goal is reachable, which would boost the profit. The companies talking about a $99 calculator agree that $5 or $6 LSI can be had. Texas Instruments and Mostek, Dallas, General Instrument, Hicksville, N.Y., and Caltex, Santa Clara, Calif., are the only announced suppliers of one-chip calculator circuits. The chips are publicly priced at $12 to $15 in large quantities. But at least five other LSI makers are vying for business, and at least one of these has signed a multi-million dollar contract to deliver one-chip calculator circuits this year at $5 each.

North American Rockwell is building a circuit for Sharp Electronics Corp. in Japan (and is reportedly building a complete machine for Sears); American Micro-systems Inc., Santa Clara, Calif., is building a chip for Unicorn, an AMI subsidiary; Nortec Electronics Corp., Santa Clara, Calif., is building one for Omron Tateisi Electronics Co., in Japan, a newcomer; Standard Microsystems is building a chip for Commodore; and Caltex is fabricating a chip for Eiko. With this competition, most suppliers will probably be willing to sell four-function-plus-constant and either fixed- or floating-point calculator chips for S5 or $6 in high volume. And Tl, now supplying Eldorado Electrodata Corp., Concord. Calif, and Bowmar/Ali, Inc., Acton, Mass., with chips, will probably meet the S5 price.

That leaves the maker of a $99 calculator the task of finding a manufacturer of 10 cents-per-switch keys and $l-per-driven-digit displays, or finding the technology to build them in house. One well publicized example of the latter is Ragen Precision Industries, North Arlington, N.J. Their machine, with its complementary MOS logic and liquid crystal display, has progressed to a model that turns on the display, but doesn't do any calculating. [It is believed that this Ragen calculator was never sold commercially.]

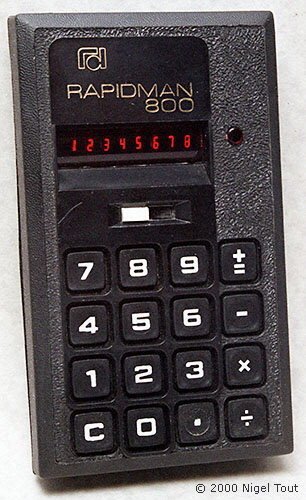

In the meantime, Germain, shopping around for another pocket calculator, has ordered 20,000 from Toronto, Ont., company, Rapid Data Systems & Equipment Ltd. Its Rapidman 800, somewhat larger than Ragen's machine, is expected to sell for under $100.

The low-cost RAPIDMAN 800 from Rapid Data Systems & Equipment Ltd., of Canada.

The low-cost was achieved by, for example:

- Using a one-piece polypropylene moulding for the whole casing and keys (see picture below).

- Employing a low-functionality Mostek MK5010P calculator-on-a-chip (the calculator has a fixed decimal point set at two places of decimals).

In November 1973 the journal New Scientist noted[16]:

"... today's market for components is no longer merely with the weapons firms and the computer main-frame manufacturers. The industry is now shipping large quantities of ICs for non-logic applications—including circuits destined for memories and other computer peripherals, industrial automation and test gear, and a whole range of new consumer products.

The explosive growth in pocket calculators, for instance, has only come through the introduction of LSI chips. And now most colour televisions are almost entirely solid-state. The product tipped as the next big consumer of integrated circuits is the budget-priced electronic watch, once the battery size can be shrunk sufficiently and liquid crystal displays operating continuously can replace the present LED (light emitting diode) digital read-outs.

Even the pocket calculator market is far from being saturated. Machines currently selling for around $90 are expected to fall to $30 within 18 months. Dr R. S. Carlson, head of Rockwell International's microelectronics division, believes that this year, 3.5 to 4 million pocket calculators will be sold in the United States. The prices of budget calculators have been halved successively over the past three half-yearly periods. This week, for instance, an 8-digit machine is available in London for under £24 (including VAT). By Christmas the price will have dropped to less than £20—which is bringing LSI components almost into the realm of the mass household market."

In June 1974 the journal "New Scientist" reported[17]:

"Calculator prices continue to plummet...

Fifteen million calculators were sold last year to customers around the world. Price cutting had become so vicious, however, that despite the soaring number of units sold, the total value of the market

actually dropped.

Stocks held by suppliers are still very high and manufacturers are pressing to keep their production lines running, and consumers are expected to benefit from still more price cutting—giving perhaps a £10 calculator by Christmas. Meanwhile, anxious manufacturers are moving up-market to more expensive scientific calculators to seek new sales.

Altogether, 810 000 calculators were supplied in Britain last year, but only 600 000 were sold to end-users. The rest went into increasing stocks and goods in transit.

With suppliers carrying so much stock, many are clearly going to face severe losses as manufacturers inevitably slash their recommended retail prices still further to keep the production lines working. Last Saturday, Sinclair took £10 off its basic four-function Cambridge, now retailing at £19-95 plus VAT [tax].

The price war has already been so rough that 12 companies quit the UK calculator market last year.

Meanwhile, Japan's share of the world market has dropped from 80 per cent in 1971 to only 40 per cent last year. The average price of calculators leaving Japan fell from $275 each early in 1971 to $60 late last year. In 1970, total Japanese production was 1-5 million. units worth $480 million; last year it was 10 million calculators worth only $400 million.

. . . leading to upmarket calculators for scientists

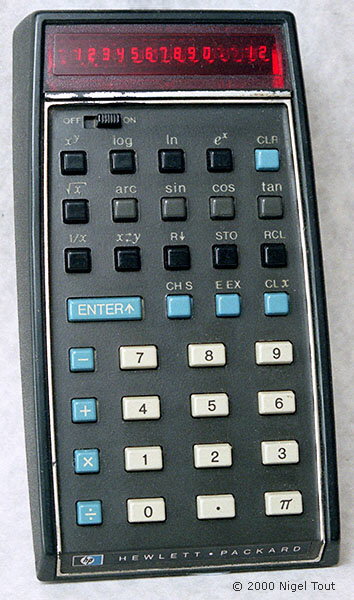

One result of the price war at the bottom end of the business has

been to force many of the surviving pocket calculator makers to think seriously about up-marketing as fast as possible. Most have looked longingly at the superb marketing job done by Hewlett-Packard at the top end of the

pocket calculator business with its powerful HP-35 and subsequent HP-45 scientific machines (more than 250000 have been sold).

With a £125 pricetag on its cheapest model, Hewlett-Packard has become the benchmark by which other manufacturers have tried to assess value-for-money in the "electronic slide-rule" business. Most imitators are sensibly keeping well clear of Hewlett-Packard's territory tending instead to offer, say, a third of the HP-35's performance for a third of its price. In any case, they argue that this is where the bulk of the demand from scientists and engineers really lies

Basically, what tends to distinguish a multi-function scientific calculator from its more mundane brother is its ability to perform trigonometric and logarithmic functions. Also it generally uses "scientific notation", displaying a mantissa plus an exponent ranging from -99 to +99, instead of the fixed, selected or floating decimal point system. The Hewlett-Packard machines can work in both scientific notation and floating decimal point, and have up to 48 separate mathematical functions. Scientific calculators are also characterised by their "reverse Polish logic" which is more efficient than the common full-flow "algebraic logic" but tend to be less natural for the un-initiated user.

Leading the pack in the middle range of multi-function calculators now selling in the United States is the Unicom 202 SR, which has 30 functions accessed through 20 keys and sells for $195 (£81). Bowmar's model MX-100-1, at $179-95 (£75), has 20 functions, 13 of which are "scientific". Though not strictly in this bracket, Texas Instruments' SR-10 nevertheless features scientific notation, reciprocals, squares and square roots, and sells for under $100 (£42). The PC-1801 made by Sharp of Japan has the 12 standard scientific functions and retails for around $200 (£83). Another Japanese manufacturer, Casio, is reported also to have a 12 function scientific machine now ready for export. It is expected to sell in the West for $85 (£35).

The first stripped-down pocket sized scientific calculator to hit the British market is Sinclair's 12-function machine, priced at around £49 (plus VAT). An independent user test carried out for New Scientist found the Sinclair Scientific to be rugged and reliable and certainly more accurate than a slide rule—with five figure accuracy being normal, but six figures becoming possible by removing the first figure of the mantissa.".

Photographs of some "electronic slide-rules":

The Hewlett-Packard HP-35, the first scientific hand-held electronic calculator set the standard for others to aspire to.

The SR-10, Texas Instruments' first "electronic slide-rule", had a few scientific functions. Texas Instruments was one of the calculator chip manufacturers which turned to making the actual calculators.

The Sinclair Scientific, a low-cost scientific calculator.

The slide-rule was still the benchmark against which electronic calculators were judged. The first electronic calculators only had the basic 4-functions of addition, subtraction, multiplication, and division and did not come up to the full functionality available on slide-rules. However, the development of calculators with scientific functions, often called "electronic slide rules" finally led to the slide-rule being ousted.

Under the headline:

"The electronic slide-rule comes of age"

the journal "New Scientist" reported in Feb. 1975[18]:

"It is now possible to buy pocket-sized scientific calculators capable of performing a range of trig, log and power functions for a third the price charged two years ago. Prices

will fall further, but not so dramatically.

Even those closest to the pocket calculator business have been overwhelmed by the pace of developments and the nose dive in prices. Indeed, so bloody has been the price war at the cheap end in particular that many a proud name has fallen by the wayside. Last week the second largest calculator manufacturer in the United States, Bowmar Instrument Corp, became the latest casualty. The company may yet survive—as an acquired or merged operation—but it will have to be slimmed down considerably.

Bowmar's problems are typical of the times. Envious of the handsome profits being made by the assembly houses who put calculators together from other suppliers' components and sell them at substantial profit, the giant US semiconductor manufacturers started to integrate their own companies vertically and moved heavily into the calculator assembly business. Texas instruments was followed by Rockwell and, more recently, National Semiconductor. They brought with them a price advantage on the vital integrated circuits, plus greater technological ability and superior financial resources—and, above all, control over the supply of microcircuits to competitive manufacturers.

Texas Instruments quickly moved into the number one position in the United States— which is by far the largest calculator market in the world, accounting for 40 per cent of all machines sold. It became clear that the only survivors in the big league would be those that were vertically integrated. And so Bowmar as an assembly house took the necessary plunge—investing $7 million in a large semiconductor plant in Chandler, Arizona. Their timing, however, couldn't have been worse: by then, many manufacturers had developed overcapacity, the shops and warehouses were stocked to overflowing, and everybody was strapped for cash. By mid-February, Bowmar reckoned its after-tax loss had soared to $20 million on a year's sales of $80 million. The company filed for protection under the federal bankruptcy law.

Ironically, some of the smaller manufacturers of calculators have been in a slightly stronger position. The shrewder ones saw the battle over the basic £8 calculator coming more than a year ago—and took steps to up-market as fast as possible. This had been made possible through the proliferation of models which, by 1973, had fragmented the market into quite well-defined sectors. These are now generally classified into four main groupings: four/five function calculators, dedicated calculators, desktop calculators, and programmable calculators. Their prices range from £8-15 for the simplest type of calculator to £2500 or more for a desktop programmable. Understandably, it is the so-called dedicated sector which has attracted most manufacturers looking to maintain profits without the worst of the cut-throat competition found at the bottom end of the business."

The rapid increase in the market for the cheaper calculators around 1972 led to shortages of integrated circuits and displays. In November 1972 "Electronics" journal reported[19]:

"LED shortage to extend into 1973

The personal-calculator industry is beset by a shortage of light-emitting diodes—and suppliers

and users expect the deficit to continue into 1973.

Monsanto's Hank Carbajal, product marketing manager for displays in Cupertino, Calif., says two factors led to the situation. First, "Many calculator makers were

counting on liquid-crystal displays; when liquid crystal didn't come about, the makers switched to LEDs." Second, there's a material shortage.

The shortage could affect prices. "The eventual price

of consumer calculators is to a large extent dictated by the availability of displays," says lan S. McCrae, opto-electronics marketing manager at Texas Instruments. "Basically, it's a materials problem - the

price and availability of the gallium-arsenide-phosphide chip. And people buying gallium-arsenide wafers and doing their own epitaxial work are finding a basic shortage of GaAs." TI's solution is to convert

customers from the 100-mil [2.5mm] digit to a 70-mil [1.75mm] size."

There were also shortages of calculator chips, as the journal Popular Electronics reported in September 1974:[20]

"Demand for Calculator Chips Exceeds Supply

The world-wide demand for microelectronic calculator circuits will far exceed supply this

year, according to C.V. Kovac, vice president and general manager of the Microelectronic Device Div. of Rockwell International Corp. In spite of the build-up of circuit capacity by nearly every manufacturer of calculators,

Kovac said that it still won't be possible to supply the demand in the exploding market in 1974, or even in 1975 and beyond if the present growth rate continues. He said that in 1974 the production of all

calculators—consumer and professional models—is expected to double the 14 million which were manufactured in 1973."

There were complaints that the semiconductor companies which had started to produce their own calculators (Texas Instruments for example) were diverting the circuits to their own assembly lines and were leaving independent calculator manufacturers short.

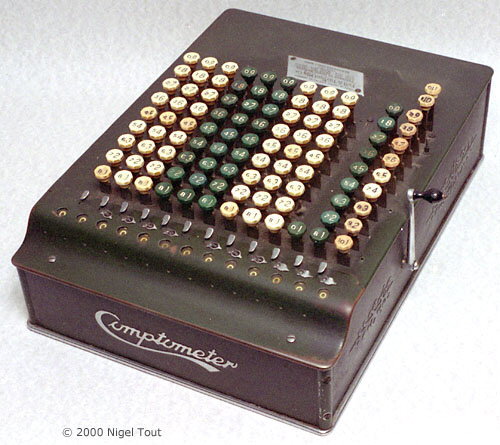

7) Electronic calculators did not have it all to themselves

There are many jobs, for example in accounting, where long lists of figures need to be added. For this task a mechanical calculator of the key-driven (Comptometer) type is faster than a standard electronic calculator since all the fingers can be used for entering a complete number in one go, so adding it to the total in one hand movement.

An article in the journal "Management in Action" for December 1970 stated[21]:

"An electronic calculator is not a substitute for the key-driven machines of

the Comptometer types when they are used in the adding role.

The nub of the problem is the keying-in time. On the standard electronic calculator each digit has to be entered successively, including significant 0s, after

which a function key (+ and/or =) has to be pressed. Take, for example, the figure 39407.05. This takes nine depressions on an electronic calculator, including the decimal point and the function key.

On the

key-driven adding machine [such as a Comptometer], each digit is entered in its appropriate column and is added at the moment of entry. Significant 0s are not entered. Thus, for example, 39407.05 requires only five key

depressions, which can be made simultaneously by a skilled operator. Thus a Comptometer operator enters the whole number in one simultaneous depression.

In fact, as yet there are no more effective machines in the adding

role than the familiar Comptometers, Duplexes, and Plus-adders, though the full keyboard Anitas have gone some way to solving this problem.

The key-driven machine remains the fastest adding machine, but the electronic calculator will do at least half as much again of multiplication and division, often more, and requires a much lower degree of training of operators. It follows, therefore, that in any office where the mainly adding functions can be separated from the mainly calculating (ie, multiplication and division) functions, then this should be done, with the 'Comps' and highly trained operators carrying out the adding, and the newer, younger, and less highly trained girls operating the electronic calculators to carry out the multiplication and division. A side product of such a policy is to minimise the re-training of Comptometer operators, with normal wastage taking care of staff replacements."

Job advertisements for Comptometer operators continued into the late 1970s. The Comptometer type of machine was ousted by computerisation rather than electronic calculators.

A model J, British Sterling currency (£sd), Comptometer.

"Full-keyboard" machines like this were very fast for adding lists of numbers and so were widely used through the 1970s in competition to electronic calculators in some applications such as accounting.

8) Coming of age of the calculator business

By November 1975 the market place was being flooded with calculators, from the simple 4-function models for about US$8 (about £5 GBP) to programmable scientific models for about US$80 (about £50 GBP). They were now within the pocket of nearly everyone.

An article in the journal New Scientist under the above headline summarised the situation[22]:

"Five years is a long time in the calculator

business. Many firms in at the beginning have fallen by the wayside, and a number of big name shave burnt their fingers thinking profits would come easily and be plentiful. Now the market is beginning to stabilise under

the influence of a few latecomers who have the financial and technical strength to survive the present recession.

There has never been anything quite like the calculator business. No mass produced technical product has sold in quite so many numbers in so short a period of time. The transistor radio came perhaps the closest, but that was essentially a "replacement" product—not one that set out to create and satisfy a hitherto largely unrealised need. The new electronic digital watch, by contrast, is more in the main-stream of the replacement product-like the portable radio and, to a lesser extent, the colour television receiver.

The calculator industry itself—along with many of its executives—has grown old almost before its time. Five years ago, the pocket calculator business did not exist; this year it is reckoned to have produced some 50 million units and sold them for an estimated $2500 million. The US market still accounts for 40 per cent of the production, but is expected to reach saturation within two years time. Saturation of the European market will follow two to three years later. Even so, the replacement market world-wide could then still exceed 50 million units annually. The birth, growth and middle-age maturity will then have come to the calculator industry all within the space of a decade.

Ironically, none of the established manufacturers of electro-mechanical calculating machines (including Friden, Victor, Burroughs, Monroe, Olivetti and Marchant) anticipated the trend towards the electronic calculator. The new technology became available in the early 1960s. One company that was quick off the mark was a British firm called Bell Punch Company which produced the world's first commercial electronic calculator in 1963 under the brand name Anita. This was the signal for the electronics industry to move bodily into what had previously been the province solely of the office equipment suppliers. The Anita machine was built under license by numerous foreign firms, including Olympia in the United States and Sharp in Japan, neither of whom had had much previous experience of adding machines let alone calculators [note that no other documentation has come to light to support the Anita machine being built under license]. Their strength lay instead in the assembly of electrical and electronic products. And machines like the early Anita contained up to 10 printed circuit boards with thousands of transistorised components soldered on to them. It was not long before many more Japanese firms, with all their manufacturing capacity and know-how for assembling electronic packages, muscled into the market. Names like Busicom, Ricoh, Sanyo, Sharp Canon and Casio were subsequently to dominate the electronic calculator business throughout the latter half of the 1960s and into the early 1970s.

But these calculators were still cumbersome desk-top machines of limited performance, relying on discrete components and bulky "Nixie" tube displays. With their cheap, well-trained labour experienced in soldering individual electronic components in their thousands, the Japanese firms held the production advantage until the arrival of large-scale integrated circuits. The LSI revolution started by specialist semiconductor suppliers like General Microsystems Inc along the 30 mile strip between San Francisco and San Jose (known nowadays as Silicon Gulch) effectively wiped out the cheap labour advantage of South-East Asia in a single stroke—and ensured that the market for pocket-sized calculators henceforth would be dominated overwhelmingly by US firms.

"Vertical integration", from the bottom up, then became the fashion. The world's largest supplier of semiconductor components, Texas Instruments, started manufacturing calculators late in 1972, and was joined by National Semiconductor in 1973.

While the major semiconductor suppliers were attracted by the large profit margins on finished calculators, the leading calculator assembly houses grew anxious about the supply of components and several consequently began to integrate the business downwards. However, the more sensible stopped short of actually manufacturing chips, but designed their own integrated circuits and then farmed them out to other semiconductor suppliers to manufacture for them.

Though prices were still relatively high (the cheapest four-function machine still cost more than £30 in 1973), the pocket calculator quickly caught the public's imagination. Sales rocketed and prices crashed accordingly. Between 1968 and 1972, five of the original 18 firms involved in pioneering electronic calculators had dropped out, but 35 new names had joined the ranks. Since then, many other big names have fallen by the wayside, including Anita, SCM/Marchant, Rapidata, Summit, Seiko and Sony. Even Bowmar ultimately had to file for protection under "Chapter XI" of the US bankruptcy law. Unicom was submerged into Rockwell and Remington Rand departed from the field. What happened to the profits ?

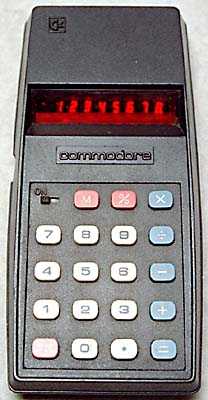

This year the big vertically integrated calculator firms have seen their profits vanish, and some of the calculator assembly houses are now in really deep trouble. Even Commodore is struggling to survive. Two weeks ago the firm reported its end of year results, which showed a $4.3 million loss on sales which were up 12 per cent over the year to $55.9 million. Commodore is now pinning most of its hopes on the European market, which is nowhere near as stagnant as the American market has been lately. (See below)

Only a handful of calculator firms look like surviving the present recession and the names that British retailers quote with confidence include Texas Instruments, Hewlett-Packard, Commodore (CBM), Litronix and Sinclair. Vertical integration in itself is no longer seen as the best way of ensuring survival. Certainly firms like Texas Instruments, who make practically all the components that go into their calculators themselves, will continue to dominate the market—not by virtue of their vertical integration but really because of their overall financial strength. But given a replacement market of 50 million units per year, the industry is obviously settling down to an era of maturity, which will be dominated by one or two really large suppliers and supported by a number of smaller companies specialising in more innovative designs. The prices of pocket calculators are not likely to fall appreciably, but the user will continue to get increasing calculating power for his money."

The article above mentions that Commodore was having financial problems. One way that the company attempted to overcome this was by vertical integration by buying a semiconductor manufacturer, as explained in New Scientist in September 1976[23]:

"Commodore, the Canadian owned American based calculator manufacturer which markets under the name CBM in Britain, has announced its intention of

entering integrated circuit component manufacture with a recent take-over. Unlike several of its competitors (such as Rockwell, National and Texas Instruments) who are primarily microcircuit manufacturers but who have also

integrated vertically upwards into end-products like calculators, Commodore is integrating downwards in order to protect its supply of components.

Commodore, quoted at $60 million on the New York Stock Exchange, has acquired 100 per cent of the equity of MOS Technology Inc of Pennsylvania in exchange for a 9.4 per cent equity stake in Commodore. MOS Technology is privately owned and valued at around $12 million. It has an integrated circuit manufacturing plant in Valley Forge, Pennsylvania.

MOS Technology has been closely associated with Commodore for some years. The integrated circuit chip that went into CBM's successful SR36/37 calculator came from MOS Technology, as does the current chip for the SR7919D calculator (a model which is rumoured to have around 25 per cent of the UK scientific calculator market) and others of the current CBM range. But the firm not only makes integrated circuits for calculators, it has also lately launched a video game chip for four players and is currently marketing a successful microprocessor.

At present, Commodore produces the art-work for its calculator chips and subcontracts the chip manufacture to outside plants around the world with spare capacity. The recent purchase of factories in the Far East has enabled it to assemble electronic watch modules by this subcontracting method. But as the up-turn in the economy begins to effect the consumer electronics industry, less spare capacity is becoming available for this type of subcontracting. When considered along with the additional recent purchase of an LED display manufacturing facility, Commodore now has a completely integrated operation."

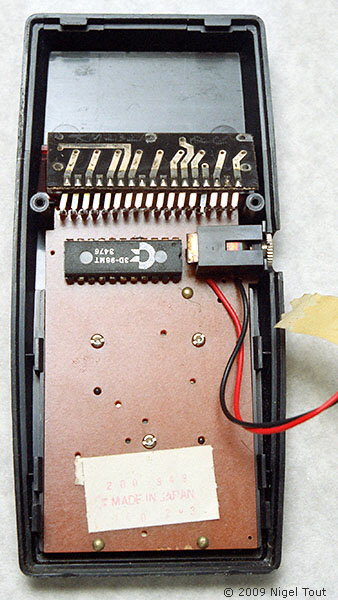

The inside of the Commodore 796M, a low-cost calculator of the mid-1970s, showing the single "calculator-on-a-chip" with its Commodore logo.

A basic 4-function calculator could hardly get simpler or cheaper. There was little profit here.

Commodore would gradually move out of the, now mature, calculator market and into the then more lucrative Personal Computer market, which was then at the start of its development cycle.

By the mid to late 1970s the calculator market had matured. Calculators had stopped being high-cost items for the few and were now low-cost commodity items for everyone. This had a drastic effect on the calculator industry with several consequences:

- Some of the big companies, such as Busicom and Bowmar which were heavily dependent on calculators made heavy losses and closed down.

- Some companies that had been big in mechanical calculators and early electronic calculators could not keep up with the competition and were bought by other companies; for example Sumlock-Anita which was bought by Rockwell.

- Other big name manufacturers left the calculator industry to concentrate on more profitable things, including Rockwell, Commodore, National Semiconductor, and Sinclair.

- Many companies and chain stores bought calculators manufactured in the cheaper labour areas of the world and had them labelled with their own names.

- Some companies managed to prosper in the calculator business by offering more features, high quality, high reliability, and reasonable. Companies such as Canon, Casio, and Sharp in Japan, and Hewlett Packard and Texas Instruments in the U.S.A. are still leading names in the calculator market, though they have also increasingly moved manufacture to the cheaper labour areas of the world.

Development efforts on calculators switched:

- To increasing battery life by reducing the power consumption. So LED (Light-Emmitting Diode) displays were ousted by LCD (Liquid Crystal Display) displays.

- To producing solar-powered calculators.

- To producing smaller and thinner calculators, culminating in credit-card sized calculators.

- To increasing functionality, such as producing programmable calculators.

- To increasing reliability. Some models had notoriously poor keyboards so that when a key was pressed several of the same digit appeared on the display, or none at all. This was very frustrating, especially during long calculations, and people learned to avoid those manufacturers. Japanese companies, especially, put emphasis on quality.

The Casio LC-78 "MINI CARD", the first credit-card size calculator (1978).

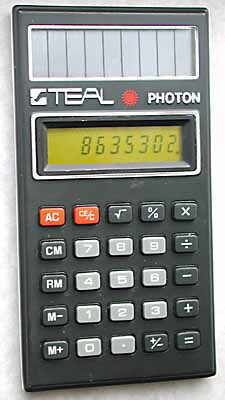

The Teal Photon, one of the first solar-powered calculators (1978).

Recognition of achievements in developing electronic calculators

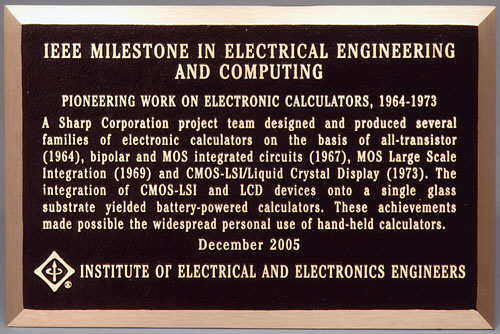

On 1st December 2005 Sharp Corporation of Japan was awarded the prestigious IEEE Milestone in Electrical Engineering and Computing by the Institute of Electrical and Electronics Engineers, of the U.S.A., in recognition of its pioneering work on electronic calculators, 1964-1973.

The IEEE Milestone in Electrical Engineering and Computing awarded by the Institute of Electrical and Electronics Engineers, of the U.S.A., to Sharp Corporation of Japan.

The IEEE Milestone and the pioneering calculators developed by Sharp Corporation to which it applies. From left to right:

There is more information about Sharp Corporation and its pioneering role in the development of electronic calculators in the Calculator Companies section of this site.

Click here to go to the section with details of Calculator Integrated Circuit Manufacturers.

Click here to go to the sections detailing the developments in calculator electronics, displays, and memory.

On Youtube the video LGR Tech Tales - The Pocket Calculator Wars summarises the tale of the development of pocket calculators.

References

- "Electronic Newsletter", Electronics, Oct. 18 1965, p26.

- "Electronics Abroad", Electronics, Jun. 10 1968, p257.

- "Electronics International", Nov. 25 1968, p12 E.

- "Use of LSI in consumer areas picks up, but problems remain", Electronic Design, Jan. 7 1971, p22.

- "Hayakawa may test TI on IC patents", Electronics, Sep. 4 1967, p201.

- "U.S. firms gird for calculator battle", Electronics, Nov. 23 1970, p83.

- "Calculators are in chips; Next: Minicomputers?", Electronic Design, Feb. 18 1971, p21.

- "Single-chip calculator hits the finish line", Electronics, Feb. 1 1971, p19.

- "The one-chip calculator is here, and it's only the beginning", Electronic Design, Feb. 18 1971, p34.

- "Price war in the calculator business", New Scientist, Jun. 29 1972, p748.

- "Challenging Japanese domination of the business calculator market, Americans are exploiting their technology not merely exporting it", Electronics, Sep. 25 1972, p69.

- "Shopping around for a calculator", New Scientist, May 31 1973, p549.

- "Special Report", Electronics, Nov. 20 1972, p96.

- Electronics Today International, Aug. 1974.

- "New calculator firms favored", Electronics, Mar. 13 1972, p120.

- "'Scary boom' in US electronics", New Scientist, Nov. 1 1973, p336.

- "Calculator prices continue to plummet ...", New Scientist, Jun. 6 1974, p614.

- "The electronic slide-rule comes of age", New Scientist, Feb. 27 1975, p506.

- "LED shortage to extend into 1973", Electronics, Nov. 6 1972, p42.

- "Demand for Calculator Chips Exceeds Supply", Popular Electronics, September 1974, p27/

- "The calculated revolution", Management in Action, Dec 1970, p6.

- "Coming of age in the calculator business", New Scientist, Nov 13 1975, Calculator supplement p ii.

- "Calculator maker integrates downwards", New Scientist, Sep. 9 1976, p541.

Vintage Calculators

Text & photographs copyright, except where stated otherwise, © Nigel Tout 2000-2026.